With issues like rising cost of living and an unstable economy, it’s hard to not worry about money at least some of the time. In fact, studies have found that finances tend to be one of the top stressors for workers, with 70% admitting to worrying or dealing with money matters at work.

So if you find yourself without steady income, your financial security would definitely be one of your more pressing concerns. After all, job or no job, there’s still bills and expenses to pay for, which, and the longer your job hunt takes, the more of your hard-earned savings will be depleted. Without any means to replenish those savings, it can be difficult to focus on job-hunting when you’re stressed about whether you’ll be able to make ends meet.

What should you do? Well, here are a few things you can do to stretch your funds while you search for a new job.

Assess your financial situation

Before you make any big decisions, the first thing you should do is to review your current financial position. For example, ask yourself this: how much are you saving per month? What are your current expenses like? Do you have a savings account or any investments? How much do you have in your emergency fund? Answer as honestly and detailed as you can, and write it down.

It’s a lot to parse through, but the more you know about your financial health, the better. Not only does it help to set your budget range, this will also give you an estimate on how much of a financial cushion you have to fall back on.

Create (or update) your budget

Without a steady income to rely on, you’re going to be a lot more mindful about your spending, which means coming up with (or updating) your budget for how to manage your money. In doing so, you can clearly identify where and what you’re spending on, which makes it easier to adjust your expenses accordingly. For example, you can rely more on public transport over taking a Grab, or resolving to eat out less often (or at least seek out cheaper alternatives).

Once you have a budget planned out, you should stick to it, though do leave some room for flexibility. After all, surprise expenses can still happen, such as an emergency hospital bill or a sudden car repair. In addition, if you can secure other avenues of income, you’ll have more assets to play around with, giving you a chance to update your budget.

Consider taking up side jobs

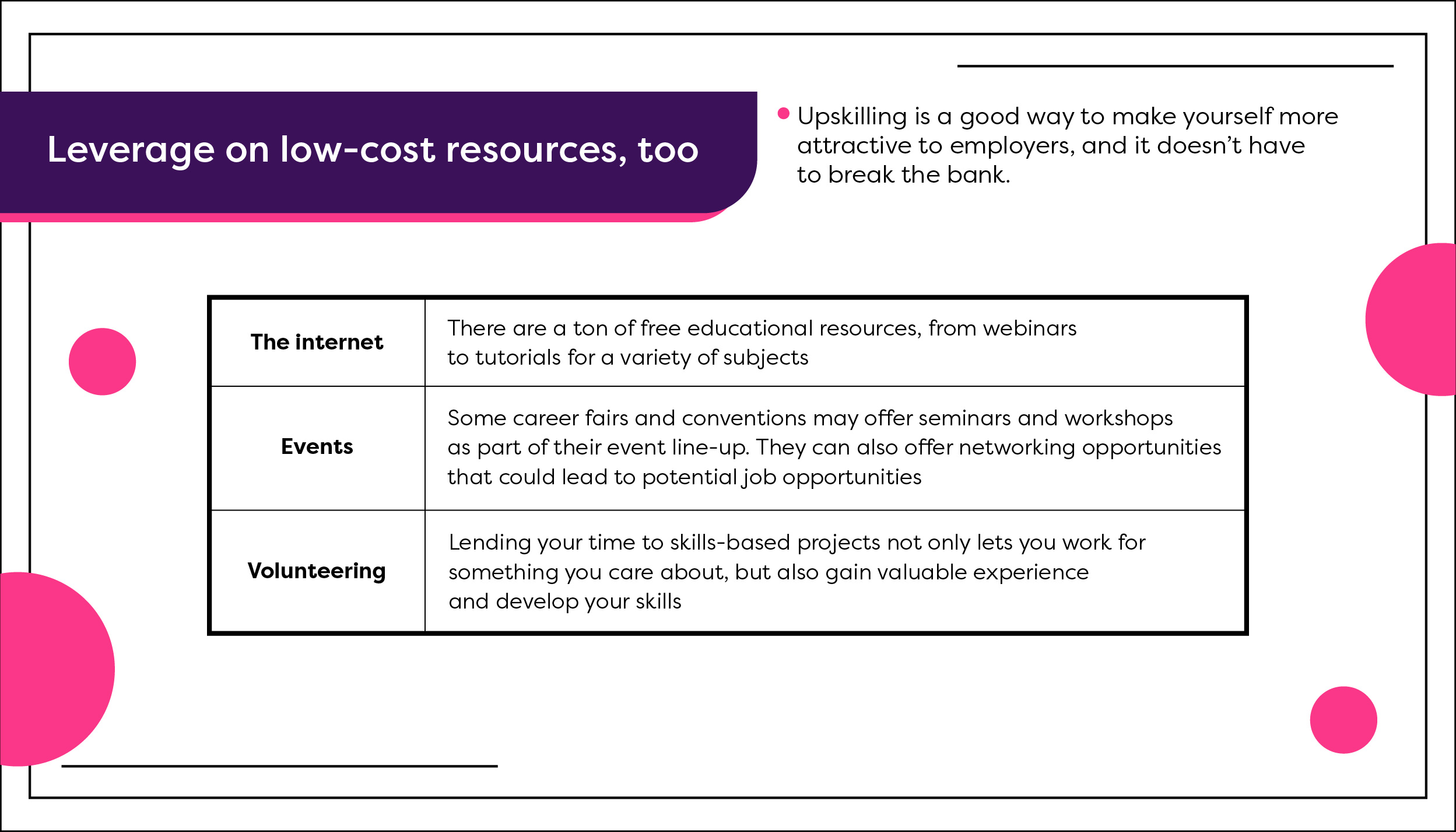

While you’re searching for full-time employment, you should also consider exploring other avenues of income if you’re able to. For example, you can apply for part-time jobs with flexible hours, or do freelance work online on platforms such as Fiverr. Not only can this help offset some of your financial stress, but the experiences themselves can be a valuable stopgap; not just by keeping you engaged in the workforce but also a chance to pick up on new skills and connections.

Keep calm and carry on

Being in-between jobs can be a financially tough spot to be in, especially since it’s not always possible to line up another job immediately afterwards. But don’t let these negative feelings impact your job search, especially when reviewing and accepting less-than-stellar job offers.

Remember, as long as you stay level-headed and mindful with your financial planning and management, keeping your finances in order isn’t as difficult as you think it is. With a better peace of mind, you’ll be able to focus on your job hunt and find the perfect new job for yourself.